The Central Bank of Nigeria (CBN) and the Bank of Angola have signed a Memorandum of Understanding to strengthen bilateral cooperation, promote knowledge sharing, and enhance capacity building across both central banks.

The agreement was signed Thursday on the sidelines of the ongoing International Monetary Fund and World Bank Annual Meetings in Lima, Peru, by CBN Governor Olayemi Cardoso and his Angolan colleague, Manuel Antonio Tiago Dias.

According to officials, the agreement represents a new level of partnership between the two institutions and is part of a larger push for regional financial stability across Africa.

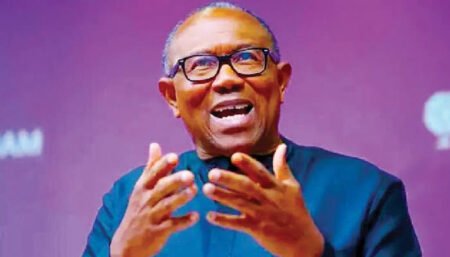

Cardoso spoke at the ceremony, which was moderated by CBN Deputy Governor (Economic Policy) Mohammed Abdullahi and attended by senior officials from both banks, describing the MoU as a “timely and significant milestone” in enhancing inter-African central banking collaboration.

“This forum brings together a multiplicity of stakeholders and interests from across the globe, and what we’ve done today highlights the spirit of cooperation that defines these annual meetings.

“The agreement provides us an opportunity to build a more interconnected and resilient African financial system capable of withstanding external shocks,” a statement issued by the apex bank on Friday stated.

The CBN governor added that the engagement is consistent with Nigeria’s strategic goal of boosting regional stability, facilitating cross-border financial integration, and strengthening institutional resilience in Africa’s monetary landscape.

Abdullahi explained that the MoU creates a formal mechanism for both central banks to exchange technical expertise, regulatory information, and supervisory best practices.

He mentioned critical areas of collaboration, such as foreign reserve management, currency operations, monetary policy coordination, payment systems, and cybersecurity.

The deal also addresses anti-money laundering and counter-terrorism financing, as well as personnel training, financial statistics creation, and research capability.

“This cooperation will strengthen our collective ability to manage systemic risks, enhance transparency, and promote financial stability in our respective countries,” Abdullahi said.

The Bank of Angola governor welcomed the collaboration, describing it as a “strategic partnership that will help both nations deepen financial integration and institutional reform.”

The framework will also support oversight of cross-border financial institutions, which is becoming increasingly important as African economies become more interconnected through trade and financial services.

“Nigeria and Angola share similar macroeconomic aspirations, maintaining stability, fostering financial inclusion, and modernizing our payment systems. This MoU allows us to work together toward these common goals,” he said.

Dias added that the agreement is also consistent with continuing efforts by African central banks to improve intra-continental coordination in accordance with the goals of the African Continental Free Trade Area and regional economic integration projects.

The pact comes at a time when African economies are increasing coordination on monetary policy, digital payments, and anti-money laundering measures in response to rising regional financial flows and global economic shocks.

It also highlights Nigeria’s revitalized diplomatic and economic outreach in Africa under President Bola Tinubu’s administration, which focuses on financial sector reforms, regional collaborations, and macroeconomic stability.

The CBN, led by Cardoso, has lately implemented a series of policy realignments aimed at restoring trust in Nigeria’s foreign exchange market and enhancing regulatory control.

The new collaboration with Angola is thus viewed as part of a larger push to strengthen African-led solutions to Africa’s financial difficulties, particularly in areas such as liquidity management, digital finance, and banking supervision.