The Nigerian Bar Association (NBA) and former Vice President Atiku Abubakar, on Tuesday, have raised concerns over alleged post-legislative alterations to the recently enacted Tax Reform Acts, calling for the immediate suspension of their implementation.

In a statement on Tuesday, NBA President Mazi Afam Osigwe (SAN) noted that the controversies surrounding the laws threaten the integrity, transparency, and credibility of Nigeria’s legislative process.

He warned that the issues strike at the heart of constitutional governance and called for a comprehensive, open, and transparent investigation to restore public trust.

“The Nigerian Bar Association considers it imperative that a comprehensive, open, and transparent investigation be conducted to clarify the circumstances surrounding the enactment of the laws and to restore public confidence in the legislative process. Until these issues are fully examined and resolved, all plans for the implementation of the Tax Reform Acts should be immediately suspended,” the statement said.

The NBA also warned that legal and policy uncertainty resulting from the controversy could unsettle the business environment, erode investor confidence, and create unpredictability for individuals, businesses, and institutions expected to comply with the laws.

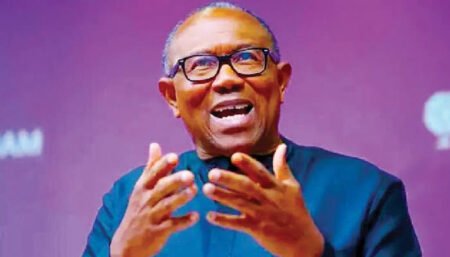

In the same vein, Atiku described the alleged alterations as a “grave assault on legislative supremacy.”

He accused the president, Bola Tinubu-led executive, of inserting coercive enforcement powers, imposing harsher financial obligations on citizens, and removing key accountability mechanisms without parliamentary approval.

Chronicle NG reported that a Sokoto lawmaker in the House of Representatives, Abdussamad Dasuki, had last week called the legislature’s attention to alleged alteration to the tax laws, saying what was officially gazetted by the Federal Government was different from the final copy passed by the lawmakers and sent to President Bola Tinubu for assent.

The House established a seven-member panel last Thursday to investigate the allegation.

On Tuesday, Atiku added his voice to the increasing demands for the executive to halt the law, set to take effect on January 1, 2026.

Atiku and the NBA both stated that the implementation should be paused while lawmakers conduct an investigation, urging the National Assembly to correct the unlawful changes and hold those responsible accountable.

Atiku urged the judiciary to eliminate unconstitutional clauses, motivated civil society and Nigerians to resist the attack on democratic values, and requested the EFCC to probe and prosecute those responsible for the purported unlawful amendments.

He said, “This draconian overreach by the executive branch undermines the foundational principle of legislative supremacy in the making of laws. It reveals a government more interested in extracting wealth from struggling citizens than empowering them to prosper.

“The following substantive changes were allegedly illegally inserted into the tax bills after parliamentary approval, in clear violation of Sections 4 and 58 of the 1999 Constitution: new coercive powers without legislative consent; arrest powers granted to tax authorities; property seizure and garnishment without court orders; and enforcement sales conducted without judicial oversight.

“These provisions transform tax collectors into quasi-law enforcement agencies, stripping Nigerians of due process protections that the National Assembly deliberately included. Increased financial burdens on citizens include a mandatory 20 percent security deposit before appealing tax assessments, compound interest on tax debts, and quarterly reporting requirements with lowered thresholds.”

Atiku said the changes create financial obstacles that make it difficult for ordinary Nigerians to contest unfair assessments while further raising compliance costs for businesses operating in a harsh economic climate.

He stated, “Removal of accountability mechanisms, deletion of quarterly and annual reporting obligations to the National Assembly, elimination of strategic planning submission requirements, and removal of ministerial supervisory provisions. By stripping away oversight mechanisms, the government has insulated itself from accountability while expanding its powers—a hallmark of authoritarian governance.

“This constitutional violation exposes a troubling reality: a government obsessed with imposing ever-increasing tax burdens on impoverished Nigerians rather than creating conditions for prosperity. Instead of investing in infrastructure, education, healthcare, and economic empowerment that would expand the tax base organically, this administration chooses the path of aggressive extraction from an already struggling populace.

“Nigeria’s poverty rate remains alarmingly high, unemployment continues to devastate families, and inflation erodes purchasing power daily. Yet, rather than supporting citizens to become more productive, thereby generating sustainable tax revenues, the government employs draconian measures to squeeze resources from people who have little left to survive.

“True economic growth comes from empowering citizens, not impoverishing them further through punitive taxation and erosion of legal protections. A thriving economy with prosperous citizens naturally generates robust tax revenues. But this requires vision, investment, and patience, qualities evidently lacking in an administration that resorts to constitutional manipulation to achieve short-term fiscal goals.”

Atiku cautioned that no legislation can be enacted unless it receives approval from the National Assembly, emphasizing that this essential principle must be maintained to prevent a descent into authoritarian governance where constitutional safeguards lose their significance.