Imagine sitting in a trading room in 2025, watching markets swing amid global tensions, yet every major transaction still hinges on the US dollar. Why does this greenback hold such unbreakable sway? Despite rising powers like China and the allure of cryptocurrencies, the dollar’s status as the world’s reserve currency endures. It dominates international reserves, trade settlements, and investments, shaping how nations and traders operate.

A reserve currency is one that central banks hold in large quantities for stability and liquidity. According to the International Monetary Fund’s latest data from Q1 2025, the dollar accounts for about 58 percent of allocated global foreign exchange reserves. This isn’t just a number; it reflects deep-rooted trust in the US economy. As someone who’s traded through booms and busts in international banks, I’ve seen firsthand how this dominance creates opportunities and risks.

In this article, we’ll explore the historical foundations, economic strength, financial depth, geopolitical factors, and emerging challenges that keep the dollar on top. By the end, you’ll understand why it’s likely to stay there for years, and how this affects everyday trading decisions.

From Bretton Woods to the Petrodollar: How the Dollar Conquered the World

The dollar’s reign didn’t happen overnight. It started after World War II, when the world was rebuilding. In 1944, at the Bretton Woods conference, 44 nations agreed to peg their currencies to the dollar, which was backed by gold. This system made the dollar the anchor for global stability.

By the 1970s, things shifted. President Nixon ended the gold standard in 1971, turning the dollar into a fiat currency based on faith in the US government. But the real game-changer was the petrodollar deal. The US struck agreements with Saudi Arabia and other OPEC nations to price oil in dollars. In return, the US offered military protection.

This created a cycle. Oil exporters earned dollars and reinvested them in US assets, boosting demand. From my days at a major bank, I recall how this setup fueled massive capital flows, making the dollar indispensable for energy trades.

Today, even as green energy rises, oil remains king. Over 80 percent of global crude is still priced in dollars. This historical inertia is tough to break; it built networks that alternatives struggle to match.

Economic Giant: Why the US is the Backbone of the Dollar

At its core, the dollar’s strength stems from America’s economic might. The US boasts the world’s largest economy, with a GDP exceeding $30 trillion in 2025, representing about 26 percent of global nominal GDP per IMF estimates.

This isn’t just size; it’s innovation and productivity. Think Silicon Valley driving tech revolutions or Wall Street funding startups. The Federal Reserve plays a key role too, with its independent policies keeping inflation in check and interest rates predictable.

During crises, like the 2008 financial meltdown or the 2020 pandemic, the dollar often strengthens as a safe haven. Investors flock to US Treasuries, seen as risk-free. In my trading career, I’ve watched yields drop while demand surges, reinforcing the dollar’s appeal.

Stability matters. Unlike some emerging markets with volatile policies, the US offers consistent growth. This draws foreign capital, sustaining the dollar’s reserve status amid uncertainties elsewhere.

Liquid Ocean: US Markets as a Magnet for Capital

No other financial system matches the US in depth and liquidity. The Treasury market alone is worth over $25 trillion, allowing seamless buying and selling without price swings.

Daily forex turnover hits around $7.5 trillion globally, with the dollar involved in 88 percent of trades, based on the Bank for International Settlements’ preliminary 2025 data. This liquidity means central banks can hold dollars without fear of illiquidity traps.

Compare that to rivals. China’s bond market is growing but lacks full openness. Euro markets are deep yet fragmented by EU politics. US markets, however, offer round-the-clock access and diverse instruments.

From experience, this setup lets traders hedge risks efficiently. Whether it’s derivatives or stocks, the infrastructure pulls in capital, creating a self-reinforcing loop that cements the dollar’s dominance.

Politics and Law: The Invisible Chains of the Dollar

Geopolitics seals the deal. The US wields the dollar as a tool in sanctions, like those against Russia since 2022, freezing assets and cutting off SWIFT access. This power deters challengers.

Rule of law underpins it all. Independent courts and transparent regulations build trust. Nations hold dollars knowing their investments are protected from arbitrary seizures.

Network effects amplify this. Everyone uses dollars because everyone else does, from trade invoices to reserves. SWIFT, the global payment system, processes over 40 percent of transactions in dollars, per recent trackers.

In my analyst role, I’ve advised clients on navigating these dynamics. Political stability in the US, despite elections, contrasts with autocratic controls in places like China, where capital flows are restricted.

Threats on the Horizon: Euro, Yuan, and Crypto vs. the Dollar

Challenges exist, though. The euro holds about 20 percent of reserves, backed by a stable bloc. But EU divisions limit its reach.

China’s yuan is rising, now at roughly 3 percent of reserves per IMF Q1 2025 data, up from negligible levels a decade ago. Yet capital controls and opacity hinder full convertibility.

Cryptocurrencies promise decentralization, but volatility makes them unfit for reserves. Bitcoin swings wildly, unlike the dollar’s steadiness.

BRICS nations push dedollarization, experimenting with local currencies. Progress is slow; trade among them still often settles in dollars.

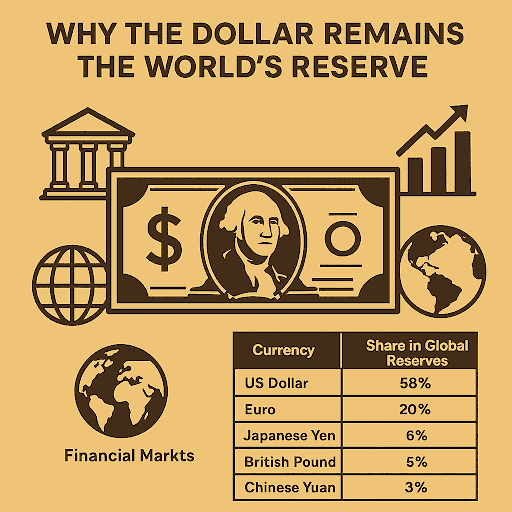

To illustrate, here’s a snapshot of global reserve shares:

| Currency | Share in Global Reserves (Q1 2025, IMF) |

| US Dollar | 58% |

| Euro | 20% |

| Japanese Yen | 6% |

| British Pound | 5% |

| Chinese Yuan | 3% |

| Others | 8% |

This table shows the dollar’s lead, but diversification is creeping in.

The Dollar in the Future: Lessons for Traders and Investors

Summing up, the dollar’s reserve status rests on history, economic power, market depth, and geopolitics. These pillars withstand current pressures, likely holding firm through the 2030s.

For traders, this means opportunities in dollar pairs. Learn to trade GBP/USD, for instance, by watching Fed decisions and global events that drive safe-haven flows.

Diversify wisely: hold some euros or yuan for hedges, but keep the dollar central. Monitor AI-driven finance and digital currencies, which could disrupt but not dethrone soon.

As a seasoned trader, I believe the dollar isn’t eternal, but it’s still king. Stay informed, adapt, and you’ll thrive in this dollar-centric world.