The Economic and Financial Crimes Commission (EFCC) has called on Designated Non-Financial Businesses and Professions (DNFBPs) to ensure compliance with the Money Laundering Prohibition and Prevention Act 2022, emphasizing their critical role in curbing criminal activities and improving national security.

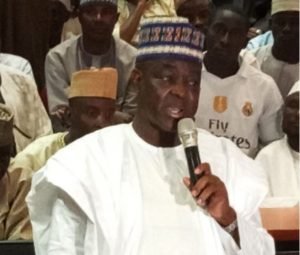

Speaking during a one-day sensitization programme organized by the Special Control Unit Against Money Laundering (SCUML) in Lagos, Michael T. Wetkaz, the Acting Director of the Lagos Directorate of the EFCC, highlighted the global focus on countering terrorism and money laundering.

Wetkaz warned DNFBPs to ensure their operations do not provide loopholes for criminal elements to thrive.

“The financial institutions, to a large extent, have been regulated, and the issues of terrorism have been of great concern globally. As a result, nations have tightened measures to ensure that the bad people have very limited space or even no space to operate, thereby helping to improve safety and security. But if you allow these criminal activities to pass through your businesses, it will worsen the insecurity situation in the country,” Wetkaz stated.

He urged participants to take responsibility and adhere to the reporting obligations outlined in the legislation.

“Please, do your part and report activities that you are obligated to report. We are doing our part to sensitize you so that you know what you are supposed to do and are not caught on the wrong side of the law. We should all work together to make it difficult for the bad actors,” Wetkaz added.

Also present at the event, Aminu Ahmed, an Assistant Commander of the EFCC, reinforced the need for DNFBP operators to report currency transactions exceeding N5 million from individuals and N10 million from corporate bodies. Ahmed further urged operators to appoint compliance officers to ensure full adherence to Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations.

“DNFBPs must not only report large transactions but also take proactive steps in ensuring compliance with all AML/CFT regulations,” Ahmed emphasized.

Folasade Oluwasanya, another Assistant Commander of the EFCC, spoke on the importance of financial sanctions and the obligations tied to Politically Exposed Persons (PEPs). She stressed the significance of reporting and awareness on beneficial ownership and targeted financial sanctions.

The event aimed to bolster DNFBPs’ understanding of their responsibilities under the law and their role in preventing money laundering and terrorism financing in Nigeria.