By Toni Kan

A wag once said that the road to hell is paved with good intentions.

This aphorism is important in considering the news from the Central Bank of Nigeria (CBN) announcing the sack of the board and executive directors of the Nigeria Incentive-Based Risk Sharing System for Agriculture Lending (NIRSAL). Those affected include the Chief Executive Officer (CEO) and Managing Director (MD), Abbas Umar Masanawa; Kennedy Nwaruh, Executive Director, Operations, and Olatunde Akande, Executive Director, Technical.

The news did not come as a surprise to many watchers and financial analysts who have followed the unraveling mess at the agricultural intervention institution which has as its tagline – “Derisking agriculture, Facilitating Agribusiness” and which was ostensibly set up to “Redefine, Dimension, Measure, Re-Price and Share agribusiness-related credit risks in Nigeria.”

Attention began to focus on the NIRSAL following the appointment of the Jim Obazee investigative committee which unraveled unsavoury tales from the CBN wholly owned NIRSAL.

It ratcheted up with the motion by House of Rep Member, Chike Okafor in July 2024 asking the House to initiate a probe into NIRSAL and others as a means of unravelling the reasons behind the food scarcity which he said was linked to the alleged mismanagement of agricultural funds intended for agricultural development in the country.

Analysts are describing the move as a bold one from the CBN which seems focused on cleaning the Augean stable at the apex bank and reintroducing a new regime of financial responsibility, corporate governance and transparency.

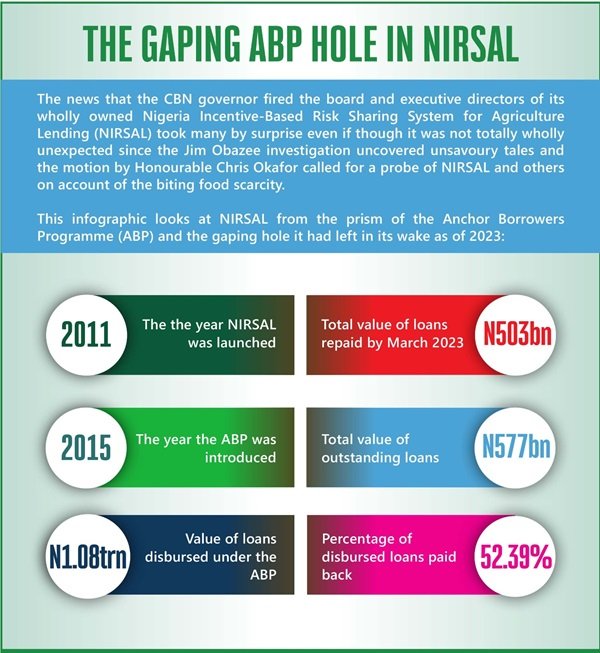

According to its profile on LinkedIn, “NIRSAL was launched in 2011 and incorporated in 2013 by the Central Bank of Nigeria (CBN) as a dynamic, holistic USD500 Million public-private initiative to catalyse the flow of finance and investments into fixed agricultural value chains. NIRSAL seeks to address the causes of low funding levels in the agriculture sector, including lack of understanding of the sector, perceived high risks, complex credit assessment processes/procedures, and high transaction costs.”

All seemed to have been going well with NIRSAL until the launch of the Anchor Borrowers Programme (ABP) under Godwin Emefiele at the CBN. The scheme was set up 2015 by the CBN and launched with fanfare by President Muhammadu Buhari on November 17, 2015. The stated objective was to create a linkage between anchor companies and smallholder farmers to complement each other along the value chain.

On paper, the ABP seemed like a laudable initiative. NIRSAL was supposed to implement the ABP using the instrument of its Credit Risk Guarantee (CRG) which was meant to facilitate the process and effectively reduce the risks of the participating financial institutions (PFI).

The CRG is described on the institution’s website as “the core service provided by NIRSAL…and an instrument issued to protect financiers and investors from possible losses in a finance/credit transaction through a risk-sharing arrangement under which NIRSAL indemnifies the lender or investor of the principal and accrued interest to the limit of a pre-agreed CRG rate.”

Under the terms of the CRG, NIRSAL was supposed to provide a guarantee of between 30%-75% depending on the borrower’s agricultural value chain (AVC) segment to the PFI at a 1% CRG fee; while the CBN is expected to bear 50% credit risk on the outstanding amount in default.

There was even as icing on the cake in the form of what NIRSAL called the Interest Drawback scheme under which borrowers who repay their loans on time receive an incentive and relief.

The design was laudable and NIRSAL has shared with pride its 6 Step Request and Issuance Process which track the request for a CRG cover to the disbursement and implementation monitoring stage. Sadly, the implementation now appears to have been anything but laudable. The loans that were disbursed to small holder farmers now appear to have been misinterpreted as grants.

Between the launch of the APB in 2015 and prior to Cardoso’s assumption of office in 2023, over N1.08trn was disbursed but only N503bn or 52.39% had been repaid leaving the CBN with over N500bn unaccounted for.

What went wrong? Many point to a weak loan structure which is difficult to accept when you consider the point already made about a robust Request and Issuance Process at NIRSAL.

Others point to insecurity arising from the intractable farmers/herders clashes while yet others allude to the headwinds from the Covid-19 pandemic as well as flooding and other vagaries of the weather.

These challenges aside, what is becoming increasingly apparent is that NIRSAL appears to have dropped the ball and failed to follow through on Step 6 of its Request and Issuance Process – “Financier disburses the loan to farmer/agribusiness and NIRSAL commences project monitoring through its nationwide Project Monitoring, Reporting & Remediation Offices (PMRO).”

This is what led to the loans, as Honourable Okafor noted in his motion, being “misused, misapplied and channeled to non-farming and non-agricultural purposes.”

So, the Anchor Borrower’s Programme was stymied by a cocktail of issues; weak loan structure, poor corporate governance, mismanagement, misapplication and poor monitoring of the loans leaving a gaping hole of half a trillion naira. Commercial banks have had their licences withdrawn for less and the management must ideally be held to account and this appears to be what the CBN has done.

But more needs to be done and it bears mentioning that NIRSAL has a list of 5 Focus Commodities which were to be prioritized, thanks to the CRGs. They are broken down into: Integrated livestock Commodity – beef, dairy, Hides and Skin; Controlled Environment Agricultural Commodity – fresh fruits and vegetables (Tomato and onions) and Aquaculture; Consumer Commodities – Rice, Potato (sweet and irish) and beans; Export Commodities – V.A Hibiscus, V.A Sesame, V.A Ginger and V.A Shea then Industrial Commodities – Maize, Soya, Wheat, Cassava and Cotton.

It is worth noting that items in NIRSAL’s 5 Focus Commodities were on the list of 43 items on which the CBN removed import restrictions. More recently, on August 28th 2024, the Nigerian Export Promotion Council (NEPC) released its Half Year performance report for 2024 and only Sesame featured in the top 3 non-oil exports for the period. It came in 3rd place after Cocoa Beans and Urea/Fertiliser.

The intention was that the country would, using the instrument of the CRG and support from NIRSAL under the ABP, achieve domestic self-sufficiency and then enough for export.

This hasn’t happened and this clearly must have informed Honourable Chike Okafor’s motion in the House and the action by the CBN.

Looking forward, one wonders what comes next after the cleaning of the stable. Will the NIRSAL baby be thrown away with the murky bathwater of the Anchor Borrower’s Programme? The answer is hopefully not, because as hitherto mentioned, all seemed to have been going well at NIRSAL until the ABP.

So, there may be a return to the drawing board, a recommitment to its core remit and disengagement from the ABP. Time will tell.

Toni Kan Onwordi is a PR expert and financial analyst