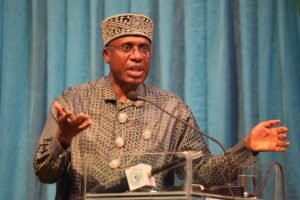

Mr. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has allayed widespread fears among Nigerians about the impending tax reforms, which are set to take effect on January 1, 2026, insisting that the exercise is not intended to burden citizens with higher rates or arbitrary revenue targets.

Speaking at the 2025 Nigeria Media Merit Award (NMMA) ceremony in Lagos this weekend, Oyedele stated that tax reform goes beyond rates and income, emphasizing that it is ultimately about rebuilding confidence between citizens and the government. “Tax reform is more than merely lowering rates or increasing revenue.

At its center, it is about the social compact of trust between citizens and the government. People pose basic yet powerful queries, such as, “Why should I pay taxes?” How is my money spent? Is the system fair, with everyone paying their fair amount, or am I the only one paying?” he asked.

According to him, such questions cannot be addressed solely by the government but must be addressed through credible, independent, and educated media interaction, with the policy being especially sensitive to disinformation due to its direct influence on livelihoods.

”A credible tax system requires fair laws, honest administration, voluntary compliance, and vigilant public scrutiny of how taxpayers’ money is spent.

“We remain committed to reforms that are fair, inclusive, and worthy of public trust,” Oyedele stated. Against this backdrop, the committee has responded to frequently asked questions by Nigerians about the Nigeria Tax Act (NTA) 2025, which takes effect in 2026.

Key Questions and Answers on the New Tax Law

- Which individuals does the Nigerian tax law apply to? It applies to all individuals who earn income in Nigeria—workers, traders, content creators, influencers, and remote workers—and to Nigerians earning income abroad if they are tax residents in Nigeria.

- Will transfers and deposits into my bank account be taxed? No. Moving money through POS, bank transfers, deposits, or withdrawals is not a taxable event. Only income earned is taxed.

- Will the money I keep in my bank account be taxed from 2026? No. Simply holding money in a bank account is not taxable. Only income such as salary, business profit, or interest is taxed.

- I am a student with no job. Will I be taxed? No. If you have no taxable income, you won’t be taxed.

- Will tax authorities monitor bank accounts more closely? Yes. Authorities will find it easier to track compliance, but bank balances themselves will not be taxed, only profits and income.

- Will I be taxed on loans borrowed from Fairmoney or other lenders? No. Loans are not income and are therefore not taxable. However, the interest earned by the lender will be taxed.

- I run a one-man business. Do I pay personal or company income tax? If registered as a business name (enterprise), you pay Personal Income Tax (PIT). If registered as a limited liability company, you pay Company Income Tax (CIT).

- If I sell shares and make a profit, will I pay tax? No, provided the value of shares sold does not exceed N150 million and the gain is not above N10 million. Gains above this threshold become taxable.

- I am a pensioner. Will my pension be taxed? No. Approved pension and retirement benefits remain tax-exempt.

- Are military salaries taxable? No. Salaries of military officers are now exempted.

- Do creatives still enjoy tax exemptions on foreign income? No. Authors, musicians, sportsmen, and other creatives must now pay Nigerian tax on income earned both within and outside Nigeria.

- Are crypto gains taxable? Yes. Profits from crypto assets, NFTs, and other digital assets are taxable.

- Who is exempt from personal income tax? Individuals earning the national minimum wage or less and those earning below N800,000 annually.

- New Progressive Tax Bands (From 2026) First N800,000 at 0% Next N2.2 million @ 15% Next N9 million @ 18% Next N13 million @ 21% Next N25 million at 23% Above N50 million at 25%

- Will severance packages be taxed? Severance pay of N50 million or less is tax-free. Any excess above N50 million will be taxed using the progressive tax bands.

- Will Nigeria tax dividends or rent earned abroad? No. Dividends, interest, rent, and royalties earned abroad are exempt if repatriated to Nigeria through approved banking channels.

- Are disability pensions for injured soldiers taxable? No. Disability pensions for members of the armed forces are completely tax-exempt.

- Will agricultural companies be taxed? No. Agricultural companies engaged in crop production, livestock, forestry, dairy, or cocoa processing will enjoy a five-year tax holiday from the commencement of operations.

- Is income from federal or state government bonds taxable? No. All government bonds are tax-exempt.

- What is rent relief under the new law? From 2026, individuals can claim rent relief of 20% of annual rent, capped at N500,000. Actual rent must be declared and verified.

- I earn N6 million yearly. Will I be better off? Under the new law, tax payable drops from N896,000 to N780,000, resulting in savings of N116,000 and higher take-home pay.

- If my company’s turnover is below N50 million, will it pay by tax? No. Small companies with a turnover below N50 million are exempt.

- As a remote worker in Nigeria for an international organization, will I pay tax? Yes, if your income is exempt in the organization’s home country under a treaty or diplomatic arrangement.

- Will a foreigner earning a salary in Nigeria be taxed? No, if the employer is a start-up or operates in tech or creative industries, and the income is already taxed in the foreigner’s country of residence.

- Will I be denied access to my bank account if I do not have a TIN by January 1? No. Any person without a TIN, can still have access to their bank account but will be asked to supply it as time goes on.

However, those who want to open a new bank account without a TIN may not be allowed.

Oyedele emphasized that the revisions are designed to safeguard low-income earners, increase justice, and encourage voluntary compliance, while also ensuring that Nigeria’s tax system promotes growth, inclusion, and accountability.