Information technology company, CWG, has announced that its partnership with Banking Enterprise Financial Crime Risk Management products company Clari5 will help African banks combat enterprise fraud and money laundering.

Through this strategic partnership, CWG and Clari5 will provide solutions to African banks to counter enterprise-wide fraud and money laundering risk.

According to the partnership, banks across Africa can now benefit from the unparalleled advantages of Clari5’s extreme real-time, cross channel, enterprise-wide fraud risk management capability.

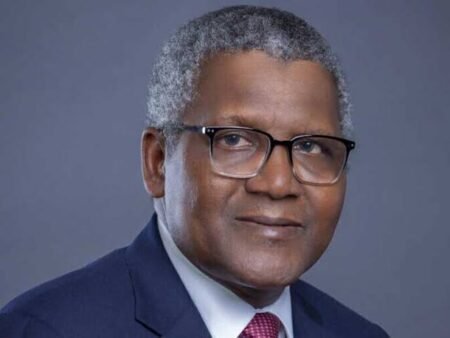

The Group Chief Executive Officer (CEO), CWG, Adewale Adeyipo, said: “We are tremendously excited to partner with Clari5. The pan-African fraud and money laundering landscape has become alarmingly sophisticated over the last few years and clearly banks are seeking more efficient solutions to combat the scourge.

“But dealing with the new reality is beyond the league of conventional, siloed anti-fraud solutions. With Clari5, banks now have the power of a world-class enterprise-wide real-time financial crime management solution that has been changing the way banks fight financial crime.”

Clari5 CEO, Rivi Varghese, said: “We believe that the best way to combat fraud and money laundering is with a solution that can behave like the human central nervous system to synthesize intelligence from across all channels of the bank in that very moment when it matters most.

“Clari5’s proven real-time product capability in thwarting financial crime, coupled with CWG’s unparalleled market reach and rich legacy of engagement successes makes it a compelling value proposition for innovative African banks to prevent bottom-line losses to financial crime. We are both proud and delighted to partner with CWG – the legendary African technology leader.”