The Central Bank of Nigeria (CBN) has apologised to bank customers for the inconveniences the reintroduced cashless policy will cause.

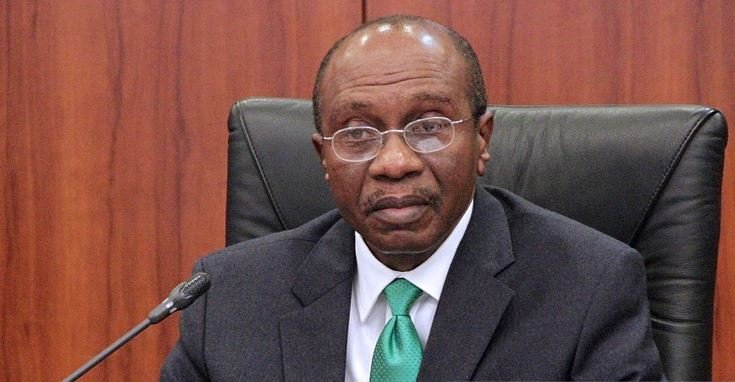

CBN governor Godwin Emefiele rendered the apology at the end of the Monetary Policy Committee (MPC) meeting in Abuja when he was asked of his reaction to the pushback from Nigerians over the return of charges on deposits and withdrawals beyond certain threshold.

At the end of the meeting, the MPC retained interest rates at 13.5% as well as other parameters.

According to him: “I truly sympathise with the banking public and regret the inconvenience that this is causing bank customers.”

Despite the apology and defending the decision, he insisted that the policy will progress as announced and gave reasons why it will continue by noting that “we expect that after five years: 2014-2019, all the cash that would have been kept in people’s houses, should have been brought back into the banking industry.

“That’s why we are saying at this time that we need to return back to that. What you are seeing today is not new.”

Emefiele gave the strategic reason why the decision to reintroduce the charges was taken.

According to him: “This is a strategic timing of these actions because on Monday, September 23rd, the mutual evaluation by Inter-Governmental Action Group against Money Laundering in West Africa (GIABA) on the country’s anti-money laundry and CFT regime will begin.

“Passing the mutual evaluation, positions Nigerian as a safe and credible destination for financial transaction across the world.”

He added that “GIABA will be in Nigeria to assess the rate at which Nigeria has embraced anti-money laundry and CFT regime.

“It is important that we display and show to them that Nigeria is indeed in conformity with their practices as enshrined in their anti-money laundry and CFA laws.

“If we do not do what we are doing today, if they pass us negative, even your so-called cards that you carry abroad, you will not be able to use them.

“It is in our own best interest that we are seen to be working in line with best global practices so that we can have a comfortable and convenient life in future.”

TheNation reports that since the policy was first launched in 2012, Emefiele stated that “currency management cost have continued to increase year-on-year at an average annual growth rate of 33%. Notwithstanding, electronic transactions have increased within the economy. We have provided alternative channels and people have embraced it.”

He maintained that “today, SMEs have various options and channels available to them for collecting legitimate payment for goods and services like bank transfers, using the POS or mobile cash, USSD codes and QR codes.

“Indeed, it is in the public interest to promote an efficient payment system via the cashless policy which helps to reduce the punitive cost of cash processing often passed on to bank customers by our Deposit Money Banks.

“Fees on excess cash withdrawal are not new. They have been there since 2012. We need to actually embrace best practices by actually saying that we should go cashless in Nigeria.”

The MPC also endorsed the increase in the Value Added Tax (VAT) rate from 5 to 7.5%.

According to Emefiele: “The government has the responsibility to fend for everybody. Fending for everybody means that it has to spend money to provide infrastructure – roads, airports, different things that will improve the lives of its people.

“There are two ways through which government can fund these expenditure. It’s either it raises revenue or goes for debt.

“You all know that the government has been criticized that the debt stock is too high.

“You all know that government has been criticized that the debt service ratios are too high. What that means is that your revenue is small because if your revenue is large, then your debt service ratios will be lower.”

He went on to state that “if we say government should not borrow, then, government must raise revenue.

“If government must raise revenue and we think this is one way government can raise revenue to meet its obligation, it calls for a rationale that what we are saying is that it is the right decision that government has taken to increase VAT from 5 to 7.5%.”

“Sometimes, we agree that this may be painful. But it is important that we understand that government also has an obligation that it must meet.

“And so, it must raise revenue. Compare the VAT rate in Nigeria to VAT rate in any part of the world. Nigeria’s VAT rate even at 7.5% stands as one-off if not the lowest in the world.”

He appealed to Nigerians “to please try to show understanding. It may seem painful. But again, it’s important for us to know that when government spends (because you are looking at the adverse consequences it will have on the purchasing power of the person who will spend).

“You should also look at the positive implication on the fact that government raises revenue, debt services ratio is lower, government can meet its obligation to improve roads or provide money for electricity, it will also have positive implication on the GDP and average growth of the country. So, which will be better then? I would rather choose (as MPC decided) that VAT will be a better option to raise revenue.”

The MPC noted the Government’s current drive to increase Value Added Tax (VAT) will improve fiscal revenue to support expenditure and reduce the budget deficit as well as Government borrowing when implemented.

The Committee, however, noted that this was too little to close the gap in Government finances.

Consequently, the MPC called on the Government to, as a matter of urgency, adopt what it termed a BIG BANG approach towards building fiscal buffers by purposefully freeing-up redundant public assets through an efficient, effective and transparent privatization process.

This, Emefiele said, would raise significant revenue for Government and resuscitate the redundant assets to generate employment and contribute effectively to national economic growth.

The MPC noted the unstable oil prices, its implications on accretion to external reserves and its persistent call on the Government to build fiscal buffers.

Consequently, the Committee called on the National Assembly to exercise restraint from increasing the oil price budget benchmark to avoid budgetary overruns at the implementation stage of the budget.

Projections from the oil futures market indicate that oil prices will remain tight around the budget oil price benchmark in the medium term.

Speaking on the controversial judgement debt of $9.6 billion awarded to P&ID, the CBN governor maintained that “by the grace of God there is no threat to the reserves…..and we have received presidential approval that those indicted should be prosecuted.”

The MPC urged the Management of the Central Bank to sustain its regulatory surveillance to ensure continued financial system stability.

The Committee noted the growth in the size of industry loans from N15.4 trillion in June to N16.23 trillion in September 2019. On the recent directives to deposit money banks to increase their Loan-to-Deposit Ratio (LDR), the Committee underscored the need to grow consumer, mortgage and corporate credit to drive aggregate demand and ensure a reduction in unemployment and increase in output growth. Consequently, the Committee urged the Management of the Bank to fast-track the development of the credit scoring system.

In addition, the Committee commended the introduction of the Global Standing Instruction (GSI) initiative aimed at de-risking credit in the industry by committing bank customers to repay their loans to banks. The MPC however, observed that the growth in credit to the private sector remained significantly low, relative to the absorptive capacity of the economy.

To stem the incidences of unemployment and insecurity, the MPC called on Government at all levels to ratchet up public works programmes aimed at easing the threat of rising unemployment in the country. This, the Committee argued, “would be achieved through efficiency in public spending.

The Committee decided by a unanimous vote to retain the Monetary Policy Rate (MPR) at 13.5 per cent and to hold all other policy parameters constant. 10 In summary, the MPC voted to: I. Retain the MPR at 13.5 per cent; II. Retain the asymmetric corridor of +200/-500 basis points around the MPR; III. Retain the CRR at 22.5 per cent; and IV. Retain the Liquidity Ratio at 30 per cent.